Steps You Need To Take To Help Reduce Financial Losses For Your Business

When you’re running your own business, safeguarding your financial health is paramount. As business owners navigate through unpredictable markets, the right strategies can mitigate risks and reduce financial losses. From precise planning to leveraging expert legal advice, the steps outlined below offer a comprehensive approach to protect your business’s bottom line.

Rigorous Financial Planning and Analysis

A cornerstone of financial resilience is rigorous planning and analysis. Understanding your business’s financial position through detailed budgeting, forecasting, and financial modelling is crucial. Regularly review your financial statements to identify trends, potential savings, and areas requiring attention. This ongoing analysis helps make informed decisions, promptly adapt strategies, and prevent unnecessary expenditures.

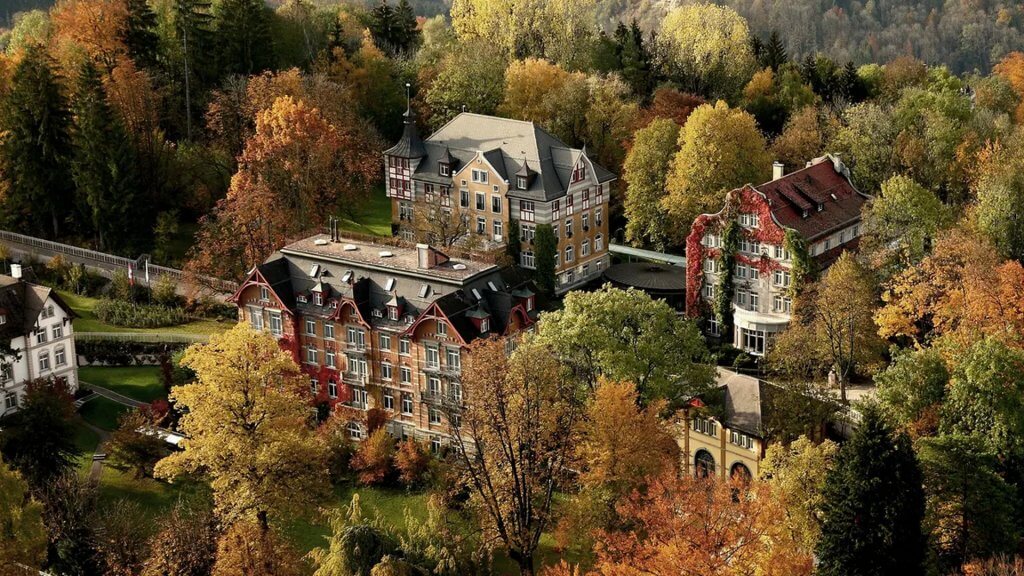

Hiring a Good Solicitor for Business

Engaging a competent solicitor specialising in business law is an invaluable step towards protecting your business’s financial interests. High-quality solicitors in Chester can offer expert advice on a range of matters, from contracts to dispute resolution. They play a crucial role in navigating the complex legal landscape, ensuring that your business operations are compliant with laws and strategically positioned to mitigate legal risks. When selecting a solicitor, look for one with a strong track record in your industry, who understands your business needs and can offer tailored advice.

Cash Flow Management

Effective cash flow management is vital for the survival and growth of any business. Ensuring that your business maintains a healthy cash flow involves monitoring incoming and outgoing funds meticulously. Strategies such as maintaining a cash reserve, how to send an invoice, timely invoicing, and managing inventory efficiently can significantly improve liquidity. Additionally, establishing good relationships with suppliers and creditors to negotiate favourable terms can provide financial flexibility in challenging times.

Diversifying Income Streams

Diversification is a key strategy to reduce reliance on a single source of income, thereby minimising financial risk. Exploring new markets, developing additional products or services, and adopting innovative business models can open alternative revenue streams. This not only cushions your business against sector-specific downturns but also offers opportunities for growth.

Implementing Strong Risk Management Practices

Identifying and managing risks proactively is essential to safeguarding your business’s financial health. This involves conducting regular risk assessments, which can help anticipate potential issues and implement preventive measures. Investing in insurance coverage is also prudent, providing a financial safety net against unforeseen events.

Leveraging Technology

Incorporating the right technology can streamline operations, improve efficiency, and significantly reduce costs. From financial management software to automation tools, technology solutions can provide real-time data, enhance decision-making, and free up valuable resources. It’s important to stay abreast of technological advancements relevant to your industry and assess how they can be integrated into your business operations.

Employee Training and Engagement

Investing in your employees through training and engagement initiatives can lead to increased productivity and reduced errors, which can positively impact your business’s financial health. A well-trained workforce is more efficient, reduces operational costs, and contributes to a positive workplace culture that drives business success.

In conclusion, reducing financial losses for your business requires a multi-faceted approach. By combining effective financial management, strategic planning, and leveraging expert advice, including that of a skilled solicitor, businesses can navigate the complexities of the market while safeguarding their financial interests. The key to financial resilience lies in being proactive, adaptable, and always prepared for the unexpected.Top of Form