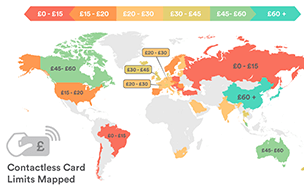

● New map shows contactless card limits in 49 countries across the globe

● Japan and China’s £100 limit more than three times the UK’s £30 cap

● Poland and Brazil have the smallest contactless allowance of around £10

All data provided by Expert

Expert

In fact, UK Finance estimates that over two-thirds, (63%), of people in the

Contactless limits vary hugely around the world and with studies linking higher limits to more frequent spending, mapping the contactless card caps of the world can

Expert Market ’s new map combines data from national banks, card providers and financial news outlets to reveal the countries with the most stringent and most generous card caps in the world.

Britain Out of Top Ten in Global Tap Battle The UK lags behind Asian countries in the contactless limit ranking, coming 13th, behind the likes of Japan, China, Canada and Australia. With a cap of just £30, Brits have around half the spending allowance of Canadians and Singaporeans and a whole £10 less than consumers in Denmark and New Zealand.

Analysis by Visa shows that increasing contactless limits can have a transformative effect on consumer spending habits. For example, when the UK limit was increased from £20 to £30 in 2016, the cashless economy experienced significant growth, particularly within the supermarket, restaurant and service station sector. Being behind this trend could not only inconvenience increasingly tap-happy shoppers, but also have a knock-on effect on the economy. Asia Ahead of Contactless Curve China and Japan, the world’s second and third largest economies, have the most liberal limits in the study – over £100 each. In fact, no less than six of the top ten countries are Asian, cementing the region ’s position as a frontrunner in the contactless payment revolution.

The relatively recent economic boom of these nations also suggests that early adopters of innovative new payment technologies, with generous limits, empower consumers and can boost the economy. ‘Tap and Go’ a No-Go in

The reluctance of US banks to invest in the infrastructure needed for ‘tap and go’ could mean that the country loses out on offering customers a quicker and easier purchasing experience and hinders both card payment and economic growth in certain sectors.

Eastern Europe & South America Not ‘Tap Happy’ Yet The bottom ten most stringent contactless caps are dominated by eight Eastern European countries, (Poland, Macedonia, Bulgaria, Russia, Croatia, Turkey, Slovenia and Hungary) and two South American countries, (Brazil and Chile) with contactless limits all under £14.

Lucy Crossfield of Expert Market comments: “Countries that are slow to adapt to new

For consumers,